E-Way Bill

E-way bill is a document generated electronically on the GST portal prior to the commencement of movement of goods

| PART A | PART B |

|---|---|

| HSN code value of goods GSTN of recipient Place of delivery Place of delivery delivery challan transport document no |

Transporter details (Vehicle number) |

GENERATE THE E-WAY BILL

-- E-way bill must be generated when there is a movement of goods of more than 50,000

-- In the case of unregistered person,the receiver will have to ensure all the compliances are met as if they were the supplier.

-- Transporter will have to generate the E-way bill,if the supplier has not registered.

• For multiple consignments being carried in the same vehicle, the transporter may prepare a consolidated e-way bill by indicating the serial number of each e-way bill.

• In case of multiple vehicles used for transport of a single vehicle, the transporter shall before such transfer update the details in Part B of Form GST EWB-01.

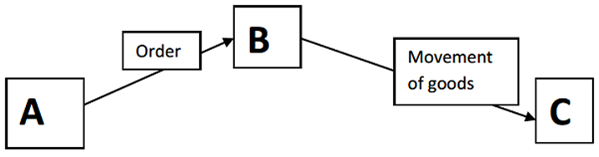

BILL-T0-SHIP-TO-MODEL

• Bill-to-ship-to Model “A” has ordered “B” to send goods to “C”.

• Here two transactions are involved i.e. from B to A and then from

A to C as per GST Act.

• The E-way bill required to be generated is only 1. If an E-way bill generated from B then his invoice details will be entered in case it is generated by A then his invoice details will be entered with the actual position of goods dispatched from and to.

VALIDITY OF E-WAY BILL

| TYPE OF CONVEYANCE | DISTANCE | VALDITY OF EWB |

|---|---|---|

| NORMAL CARGO | UPTO 100 KMS | 1 DAY |

| FOR EVERY ADDITIONAL 100 KMS OR PART THEREOF | 1 ADDITIONAL DAY | |

| OVERDIMENSIONAL CARGO | UPTO 20KMS | 1 DAY |

| FOR EVERY ADDITIONAL 20 KMS OR PART THEREOF | 1 ADDITIONAL DAY |

• If there is an error in the e-way bill,then it cannot be edited or corrected. Only option is,cancellation of e-way bill and generate a new one with correct details. It can be cancelled within 24 hour of generation of an e-way bill. However e-way bill cannot be cancelled if it is verified in transit.

Written by

Sakshi Sharma (CMA)